Shop

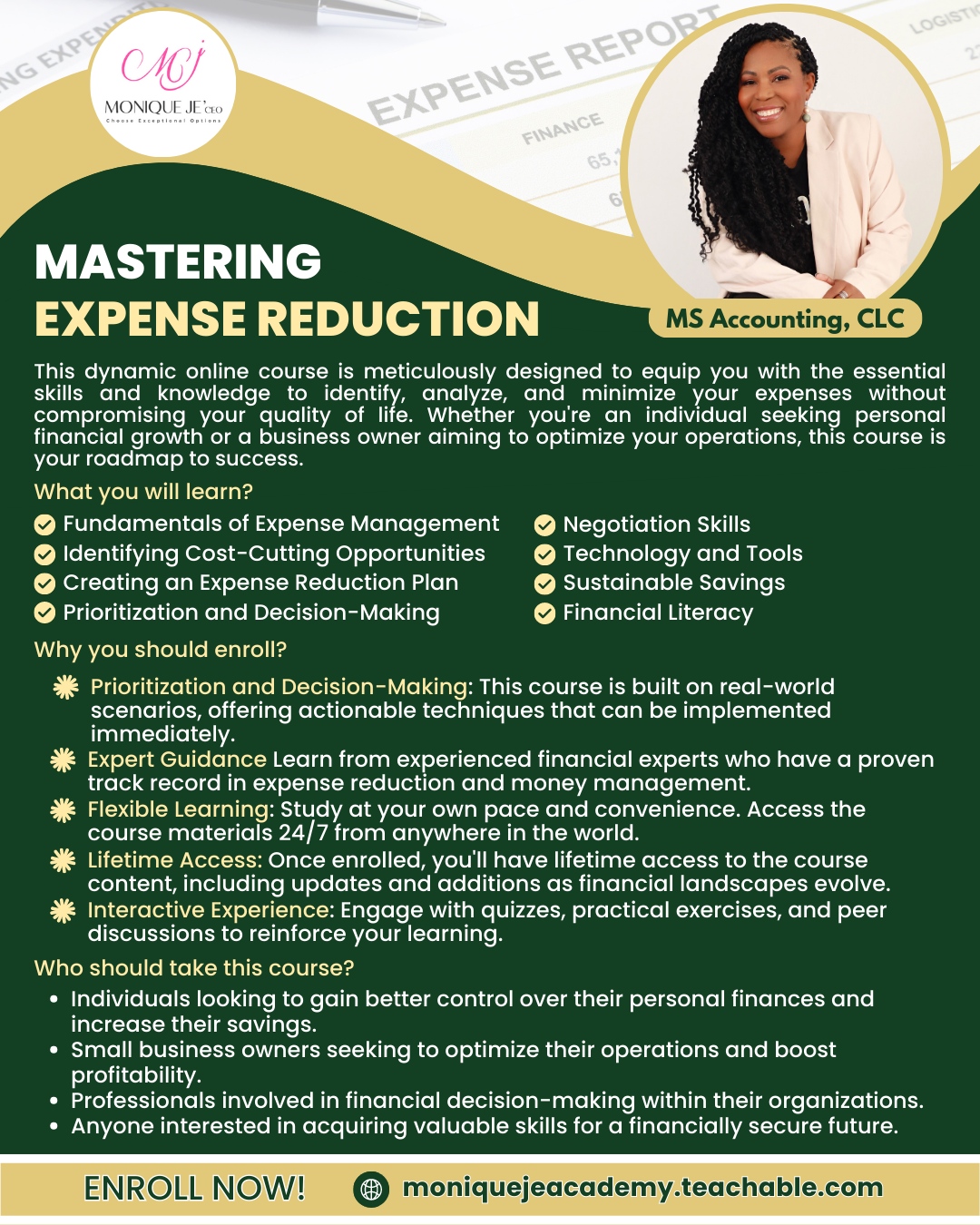

Mastering Expense Reduction Course

$999.00

-

Mastering Expense Reduction”

Tools to help reduce your monthly expenses by a minimum of $100 per month(If information is applied) to build savings or get out of debt!

Description

In today’s fast-paced world, financial stability and smart money management have never been more crucial. This dynamic online course is meticulously designed to equip you with the essential skills and knowledge to identify, analyze, and minimize your expenses without compromising your quality of life. Whether you’re an individual seeking personal financial growth or a business owner aiming to optimize your operations, this course is your roadmap to success.

Each module will consist of video lessons, downloadable resources, practical exercises, quizzes, and discussion forums to engage and support learners throughout their expense reduction journey. Students will gain both the theoretical knowledge and practical skills needed to master expense reduction and achieve their financial goals.

“Google Her” Upon full payment student will receive email with link to set up account and access to Teachable online course education platform.

What You’ll Learn:

- Fundamentals of Expense Management: Gain a solid understanding of the key concepts behind expenses, including fixed and variable costs, direct and indirect expenses, and more. Lay the groundwork for effective cost reduction strategies.

- Identifying Cost-Cutting Opportunities: Learn to spot hidden expenses and evaluate where your money is going. Discover how to conduct thorough expense audits for both personal and professional expenditures.

- Creating an Expense Reduction Plan: Develop personalized action plans to systematically cut down on unnecessary spending. Explore various approaches, from negotiation techniques to smarter consumption habits.

- Prioritization and Decision-Making: Master the art of prioritizing expenses. Gain insights into when it’s appropriate to invest in quality and when frugality is the right choice.

- Negotiation Skills: Hone your negotiation skills to secure better deals with vendors, service providers, and even employers. Learn the psychology of negotiation and effective communication strategies.

- Technology and Tools: Explore a range of digital tools and apps that can aid in tracking expenses, budgeting, and managing financial goals.

- Sustainable Savings: Understand the long-term benefits of sustainable living and how eco-friendly choices can lead to cost savings.

- Financial Literacy: Enhance your overall financial literacy by grasping concepts like compound interest, investment opportunities, and risk management.

- No refunds or credits will be issued after 30 days of being enrolled in the coaching program.

Reviews (0)

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.